The imposition of tariffs has been a hallmark of recent global trade policies, especially in the context of trade wars, protectionism, and geopolitical tensions. While tariffs are often used to protect domestic industries, generate government revenue, or retaliate against other countries’ policies, their overall impact has been mixed, with both positive and negative consequences for different sectors of the economy. A detailed analysis of recent tariff policies, particularly those implemented by the US and China, reveals a complex picture of winners and losers across industries, consumers, and international trade relationships.

1. Background: The Role of Tariffs in Modern Trade Policy

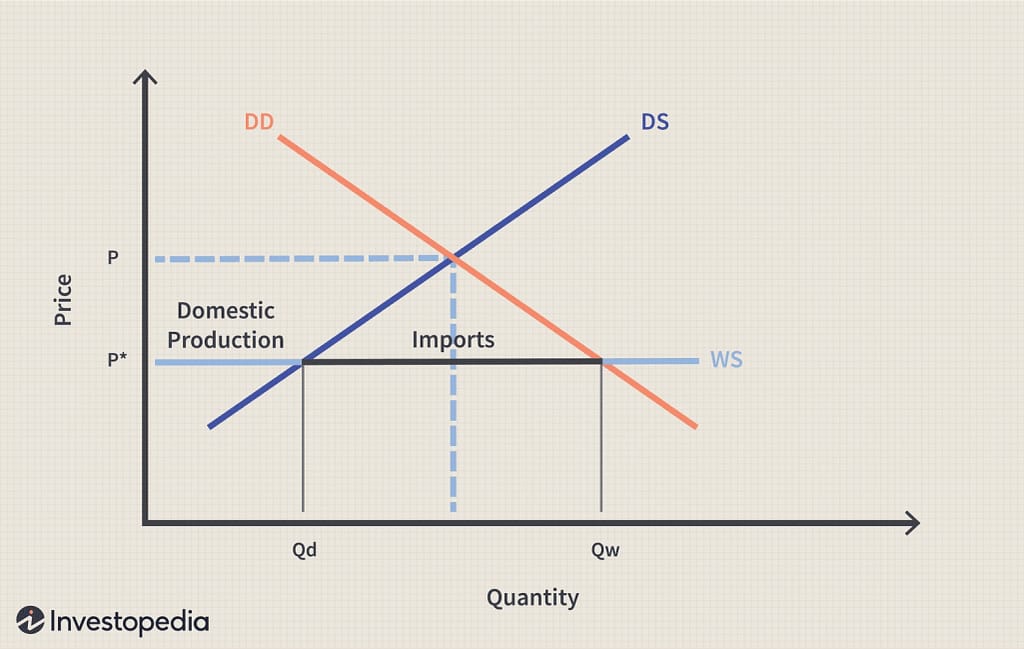

A tariff is a tax levied on imported goods and services. Governments implement tariffs for various reasons:

- Protection of domestic industries from foreign competition.

- Revenue generation for the government.

- Political leverage in trade negotiations.

- Encouragement of local production and job creation.

While tariffs can offer short-term economic protection to domestic industries, they often come with long-term trade distortions, impacting everything from supply chains to consumer prices.

2. The US-China Trade War: A Case Study in Tariff Impact

One of the most significant recent examples of tariffs’ mixed outcomes comes from the US-China trade war that began in 2018. The United States, under President Donald Trump, imposed a range of tariffs on Chinese goods, with the goal of reducing the US trade deficit with China, protecting intellectual property, and encouraging China to alter its trade practices. China retaliated with its own tariffs on US products.

The tariffs impacted a variety of industries on both sides, creating both winners and losers:

2.1. Winners: Certain Domestic Industries

Some domestic industries in the US and China benefited from the tariffs:

- US Manufacturers: Certain US industries, particularly steel and aluminum manufacturers, saw a boost as tariffs on foreign-made products made domestic goods more competitive. The US steel industry, for example, received protection from cheaper imports, allowing it to maintain market share and increase domestic production.

- Chinese Producers: In China, local manufacturers of products previously imported from the US were able to expand and capture a larger share of the domestic market. Some Chinese companies also pivoted to manufacturing goods for export to other countries that were previously sourced from the US.

2.2. Losers: Exporters and Consumers

While some industries gained, the impact on consumers and export sectors has been overwhelmingly negative:

- US Consumers: One of the most significant effects of tariffs on imported goods is higher prices for consumers. With tariffs on Chinese products (e.g., electronics, clothing, and machinery), US consumers faced higher prices on these goods. For example, US electronics retailers saw an increase in the cost of items like smartphones and computers due to Chinese tariffs, impacting household budgets.

- US Exporters: The US agricultural sector, in particular, was hit hard by China’s retaliatory tariffs on US products like soybeans, pork, and wine. As a result, US farmers faced significant revenue losses as China shifted to suppliers from other countries.

- Chinese Consumers: Similarly, Chinese consumers were also negatively affected by tariffs on US goods, leading to higher prices for American-made products. This particularly affected luxury goods and high-tech products, such as automobiles and pharmaceuticals, that were previously imported from the US.

2.3. Supply Chain Disruptions

Another notable impact of tariffs has been the disruption to global supply chains. Many companies in both the US and China have relied on interconnected supply chains, sourcing parts and raw materials from multiple countries.

- Manufacturers in both countries were forced to adjust their supply chains to account for higher costs of raw materials, parts, and finished goods, often leading to delays, inefficiencies, and higher production costs.

- Many companies in both countries also looked for alternative suppliers outside of China and the US to avoid the tariffs, resulting in shifting trade patterns and diversion of supply chains to countries like Vietnam, Mexico, and India.

3. Broader Global Impact: Mixed Effects for Third Countries

While the US and China were the primary targets of the tariff escalation, other countries were also affected in both direct and indirect ways.

3.1. Winners: Certain Emerging Markets

Some countries, particularly those in Southeast Asia, Latin America, and Africa, benefited from the shifting trade flows caused by the US-China tariffs.

- Vietnam and Mexico, in particular, were able to capitalize on trade diversions. As companies sought to avoid US tariffs on Chinese goods, many manufacturers shifted production to Vietnam, which became a significant alternative production hub, particularly for electronics and textiles. Similarly, Mexico benefited as US companies moved production closer to home due to tariff pressures on China.

3.2. Losers: Other Exporters and Developing Economies

On the flip side, countries that were heavily dependent on exports to both the US and China felt the pinch as tariffs distorted trade patterns:

- Developing economies in Africa, Latin America, and Europe that had established export relationships with both the US and China faced challenges. Tariffs affected global commodity prices, particularly for agricultural and raw materials exports, leading to price volatility in international markets.

- In Europe, certain industries that rely on exports to both the US and China, such as the automotive sector, were impacted by higher costs and delays in the delivery of key components.

3.3. Trade Diversion and Shifts in Trade Patterns

The overall effect of tariff policies has been a redistribution of global trade rather than a contraction. Tariffs have led to a shift in trade flows, as countries and companies try to avoid higher costs by finding alternative suppliers or markets.

For instance, after the US imposed tariffs on Chinese steel and aluminum, many US companies sourced these metals from other countries like Canada, Mexico, and the EU. However, this also led to trade frictions between the US and its traditional allies, highlighting the spillover effects of tariff policies.

4. Long-Term Consequences: Economic and Strategic Considerations

The long-term effects of tariffs on global trade are still unfolding, with mixed outcomes for various economies.

4.1. Structural Shifts in Global Supply Chains

Tariffs have accelerated the process of supply chain diversification, as companies seek to avoid trade barriers and reduce their dependency on any single country. This shift is likely to continue, with businesses exploring new regions for production and sourcing. As a result, Asia, particularly countries like Vietnam, India, and Thailand, is expected to play an increasingly significant role in global manufacturing.

4.2. Reduced Trade Volume and Global Economic Growth

Tariffs can also slow global trade volume, as higher costs and trade barriers discourage international exchange. According to some studies, the imposition of tariffs has already led to reduced trade flows, which in turn affects global economic growth. According to the World Trade Organization (WTO), a trade war that involves tariff hikes typically results in a net loss of economic output for all parties involved, especially in the long term.

4.3. A Shifting Political Landscape

Tariffs also have political implications, influencing international relations and alliances. For instance, the US-China trade war reshaped the dynamics between both countries, and the EU’s response to US tariffs on European goods has influenced the direction of transatlantic trade policies.

In the long run, tariffs may also prompt countries to seek trade agreements that avoid tariff escalation, leading to the creation of new trade blocs or the renegotiation of existing trade deals. For example, the US-Mexico-Canada Agreement (USMCA) was signed as a response to tariffs imposed on steel and aluminum, while China has increasingly sought trade agreements with countries like Australia and Brazil.

5. Conclusion: A Mixed and Complex Picture

The analysis of the impact of tariffs shows that their outcomes are far from uniform. While some industries and regions have benefitted from tariffs through increased protection or shifted trade flows, many others have been hurt by higher consumer prices, disrupted supply chains, and reduced market access. The ultimate impact of tariffs depends on several factors, including industry composition, geopolitical context, and the duration of the tariff policies.

- Winners include certain domestic industries in both the US and China, as well as countries that managed to attract diverted trade flows.

- Losers include consumers facing higher prices, export-dependent industries in the US and China, and countries with trade vulnerabilities due to the disruptions in global supply chains.

As the global trade landscape continues to evolve, the long-term effects of these tariff measures will depend on whether countries seek to de-escalate trade tensions and return to more collaborative economic policies, or whether tariffs will become a permanent fixture in international trade.